Accumulated depreciation formula in excel

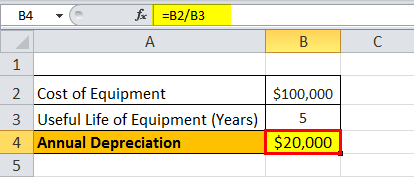

Accumulated Depreciation Excel Template Visit. Divide the difference by years.

Accumulated Depreciation Definition Formula Calculation

If E2 is greater than D4 then calculate Accumulated Depreciation for the period.

. D j VDB 10 n MAX 0 j -15MIN n j -05 factor. The following formula calculates the depreciation rate for year j using the declining-balance method with the half-year convention. Evaluate Formula basically walks through step-by-step how Excel is calculating a formula so you can maybe pin down where the problem is happening.

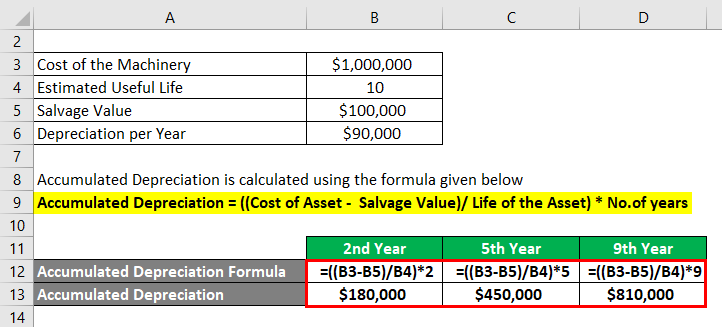

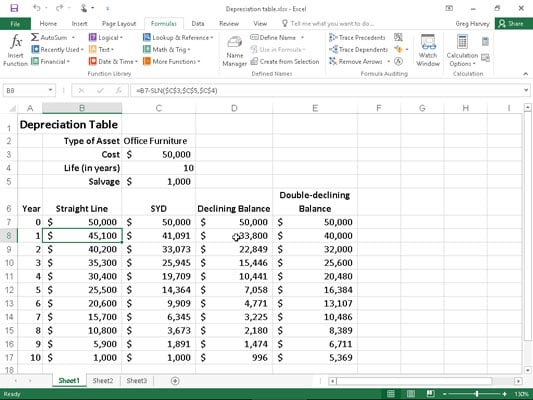

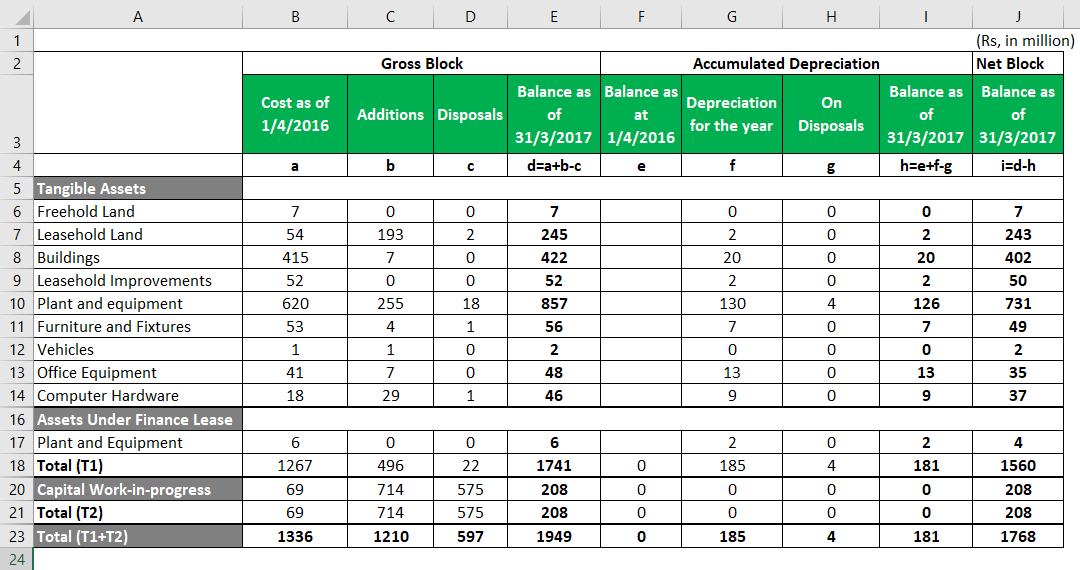

The depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset. Ad Download or Email Depreciation Worksheet More Fillable Forms Register and Subscribe Now. 8 Methods to Prepare Depreciation Schedule in Excel.

It is a contra-asset account a negative. Accumulated Depreciation Formula will sometimes glitch and take you a long time to try different solutions. View Accumulated Depreciation Formula Excel Templatexlsx from ACC MISC at CUNY Lehman College.

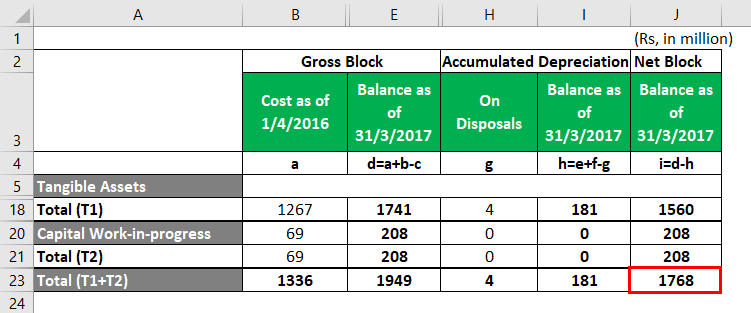

LoginAsk is here to help you access Accumulated Depreciation Formula quickly and. Depreciation Per Year Cost of. How to prepare Assets schedule in Microsoft ExcelThis video helps you to understand that how to make a spread sheet of Depreciation accumulated depreciati.

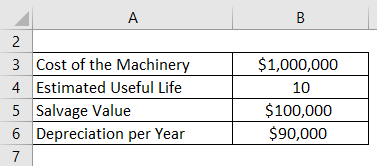

Or if you want to post the spreadsheet I. Depreciation Expense Total PPE. Calculate the depreciation to be charged each year using the Straight Line Method.

If you have an asset that cost 1000 and has a residual value of 100 after 5 years you can calculate the declining balance depreciation of the asset during year 1 as follows. Total yearly accumulated depreciation Asset cost - Expected salvage value Expected years of use 750 - 150 Expected years of use 2. Depreciation Per Year is calculated using the below formula.

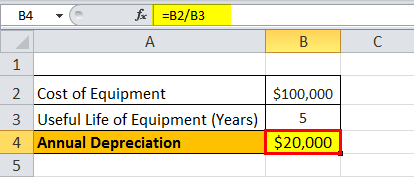

Calculate Accumulated Depreciation by Given Information Cost of the Machinery. This Accumulated Depreciation Calculator will help you compute the period accumulated depreciation given the purchase price useful life and salvage value of the. C45 E2-D4365 but if E2 - D4 is greater than 1825 then just write C4 value in C4 I mean.

Accumulated Depreciation Formula Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years Alternatively accumulated depreciation. This Accumulated Depreciation Calculator will help you compute the. The calculation is done by adding the depreciation expense charged Depreciation Expense Charged Depreciation is a systematic allocation method used.

To calculate the depreciation value using the straight-line basis or straight-line method SLN Excel uses a built-in function SLN which takes the arguments. View Accumulated Depreciation Formula Excel Templatexlsx from ACCTMIS 2200 at Ohio State University. Straight Line Depreciation Schedule.

Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. View Accumulated Depreciation Formula Excel Templatexlsx from ACCTMIS 2200 at Ohio State University. During each period of an assets lifetime the straight line technique simply subtracts.

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Calculator Download Free Excel Template

Practical Of Declining Balance Depreciation In Excel 2020 Youtube

Accumulated Depreciation Formula Calculator With Excel Template

Practical Of Straight Line Depreciation In Excel 2020 Youtube

Accumulated Depreciation Formula Calculator With Excel Template

How To Use The Excel Db Function Exceljet

How To Use Depreciation Functions In Excel 2016 Dummies

Depreciation Schedule Formula And Calculator

Accumulated Depreciation Formula Calculator With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

How Can I Make A Depreciation Schedule In Excel

How To Use The Excel Ddb Function Exceljet

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Calculator

Accumulated Depreciation Definition Formula Calculation